Own loans guideGetting a personal loanPayday Loan AlternativesManaging a private loanPersonal loan reviewsCompare leading lendersPre-qualify for a personal loanPersonal loan calculator

Obtain your no cost credit rating scoreYour credit score reportUnderstanding your credit score scoreUsing your creditImproving your creditProtecting your credit rating

Owning explained that, fascination premiums can however vary from lender to lender. Therefore, the very first thing to look for when evaluating SBA lenders is curiosity fee and little business loan APR.

To protected the best business loan fitted to you, make sure the repayment conditions align together with your financial scheduling. What type of business loans are offered?

Due to the fact then, these lenders are becoming a typical-position useful resource for business funding.When your unique desires should really dictate in which you seek funding, there are some perfectly-recognised strengths to making use of substitute lenders, including:

Through the 2008 economic downturn, on the net lenders obtained prominence instead selection for lots of little businesses to acquire financing when common financial institution funding options dried up.

We make a Fee from brands outlined on this site. This influences the get and fashion during which these listings are presented.

Whether or not you have been trying to improve, manage daily operations, or build your self a income stream basic safety Internet to handle the surprising, Kapitus can assist you Make the appropriate loan products and obtain funding on your business to meet your unique requirements.

Receiving authorized for the line of credit rating may be an extremely fast and pain-free system. As long as you have all your documentation willing to submit, you can obtain authorized in as minor as four hrs. Upon approval, you may count on for getting access to your credit line, once again, in just four hrs.

Implementing for an SBA loan generally includes a lengthier software method than for an everyday business loan. The subsequent is a summary of factor lenders might choose into account:

Obtaining federal government backing allows lenders to tackle a lot more risks With regards to offering loans to modest businesses. From the 2020 fiscal calendar year, lenders issued a combined $28 billion in SBA loans.

We're not an expenditure adviser, loan provider, see here or simply a broker and we do not supply loans or mortgages straight to stop buyers, but only will allow customers to match with lending companions and platforms that will increase a loan. All loan acceptance selections and terms are based on the loan providers at the time of one's application with them.

The APR on your loan small business relies on your business's financial history, property, money, credit history historical past, and various components. The amount of time do I should repay my business loan?

The extent of aid differs based upon if the loan was accredited and may start out on or after February one, 2021. Remember to Speak to your lender for queries on the availability of the assistance to your SBA loan.

Jenna Jameson Then & Now!

Jenna Jameson Then & Now! Jennifer Love Hewitt Then & Now!

Jennifer Love Hewitt Then & Now! Shannon Elizabeth Then & Now!

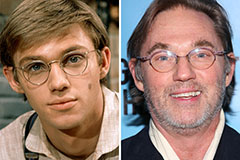

Shannon Elizabeth Then & Now! Richard Thomas Then & Now!

Richard Thomas Then & Now! Barbara Eden Then & Now!

Barbara Eden Then & Now!